上 2290 104253-2290 instructions

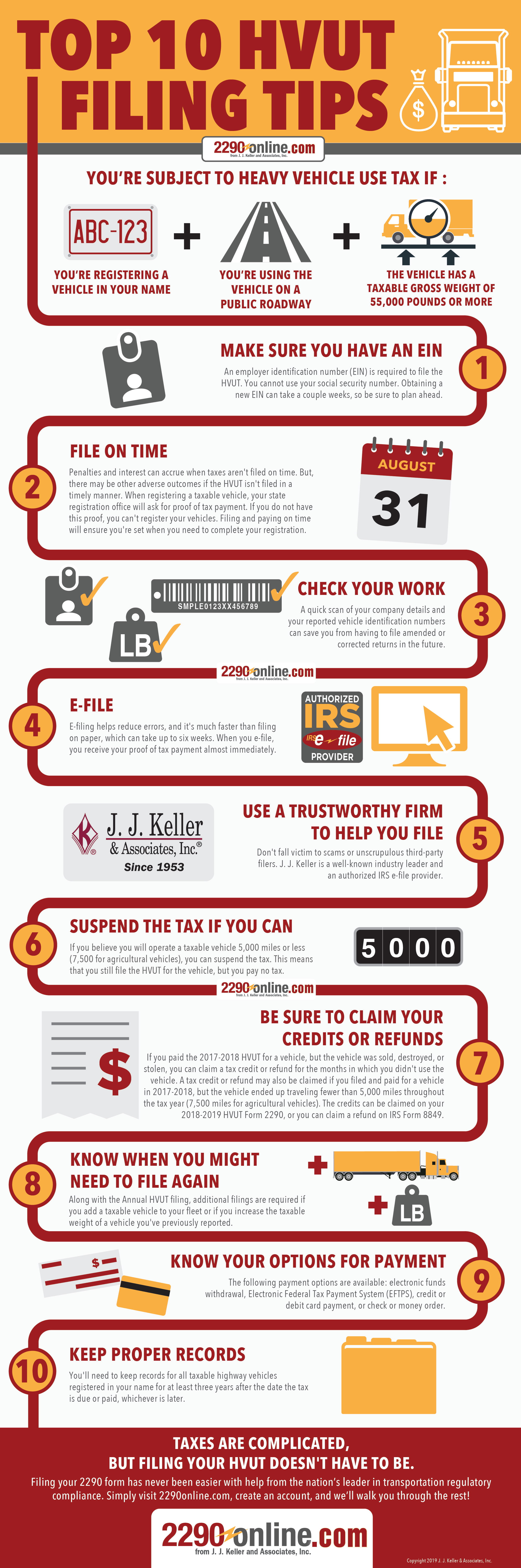

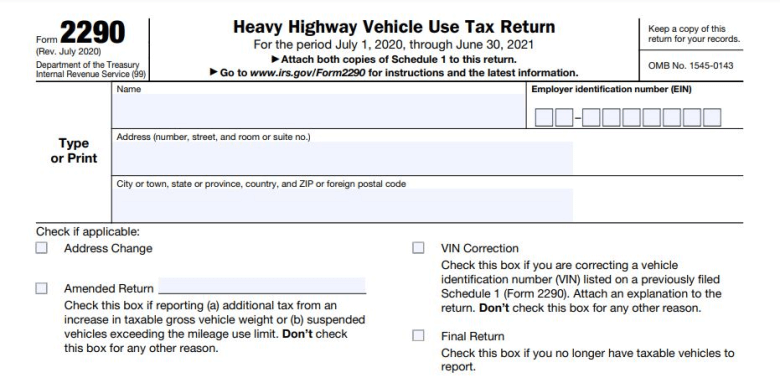

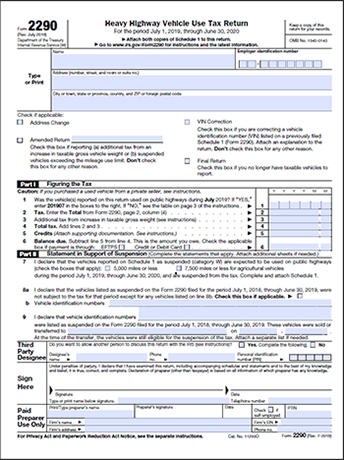

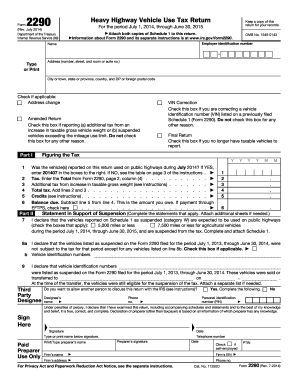

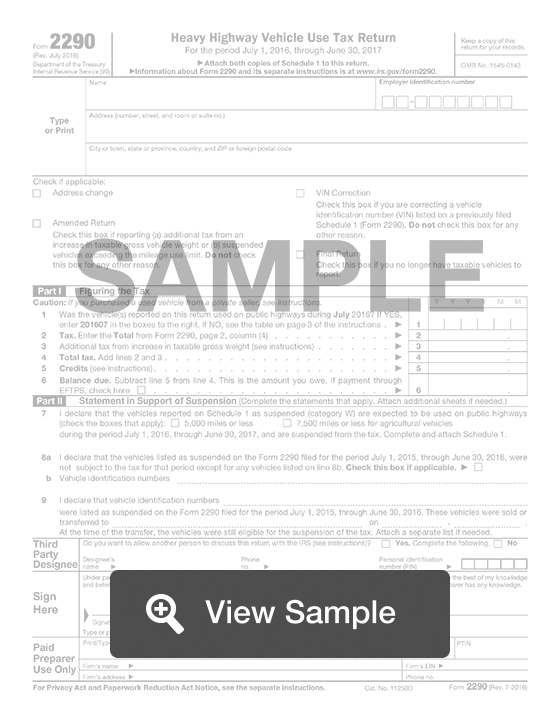

Aug 07, · Form 2290 is an annual Federal tax return filed to figure out and pay the Heavy Vehicle Use Tax (HVUT) for a tax year It has to be filed for vehicles with a taxable gross weight of 55,000 pounds or more if operated on the public highways The deadline to file your Form 2290 return depends on the First Used Month (FUM) of the vehicle for the tax year A typical tax year for Form 2290Economic & Cheaper Form 2290 efile starts at $ 2499 onwards for a single vehicle return Convenience ePay2290 is available online 24/7 File your federal 2290 HVUT returns from anywhere, anytime Ease of use User friendly and stepbystep instructions provided Greater Accuracy in Processing No calculation errors because software isE tax 2290 provides the very best high quality efiling service in the nation The Internet can supply us more information regarding this service Title management is assigned by the IRS and it is a mix of your corporation type and your name

Taxes For Truckers What Is Form 2290 1 800accountant

2290 instructions

2290 instructions-Whether you're in charge of efiling IRS Form 2290 for owner operators, your company fleet, or both, we have options that will help you file quickly and manage your duties with ease Let us help you stay organized, keep track of 2290s and Schedule's and contact the IRS on your behalfEFile IRS Form 2290 For 21 Filing heavy vehicle use tax (HVUT) form 2290 online with GreenTax2290 is quick and easy Get IRS stamped Schedule1 in minutes eFile Now!

Express2290 E File Form 2290 Online File 2290 For 21 22

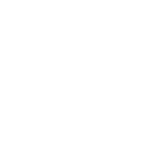

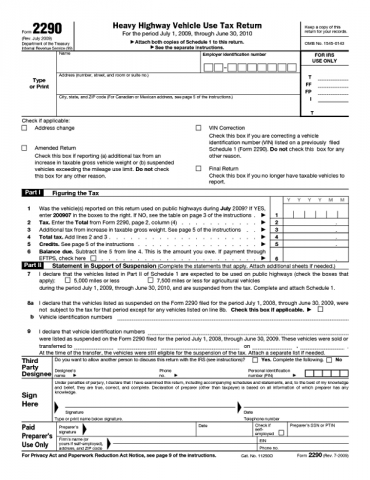

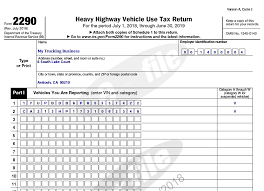

You can file Form 2290 online using wwwform2290com regardless how many trucks you want to file online;Mar 12, 21 · You must efile your Form 2290, Heavy Highway Vehicle Use Tax Return, if you are filing for 25 or more vehicles However, we encourage efiling for anyone required to file Form 2290 who wants to receive quick delivery of their watermarked Schedule 1 With efile, you'll receive it almost immediately after we accept your efiled Form 2290About Form 2290, Heavy Highway Vehicle Use Tax Return Use Form 2290 to Figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or more;

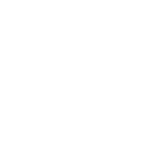

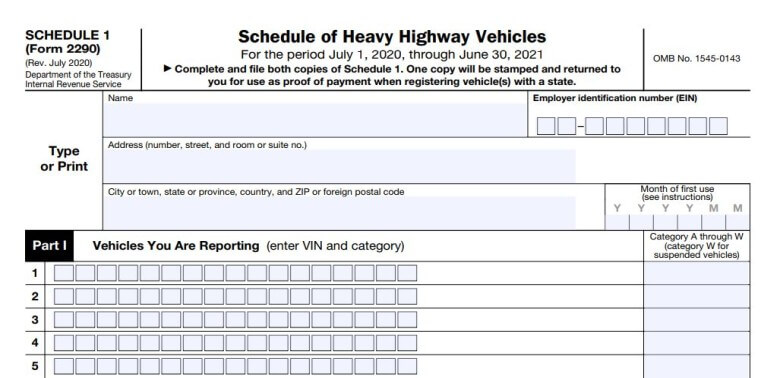

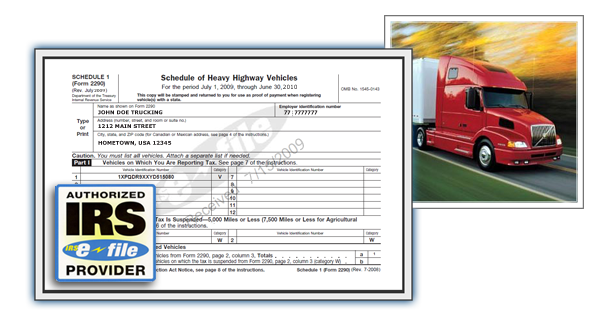

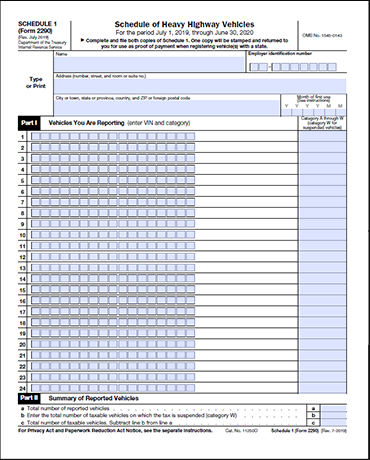

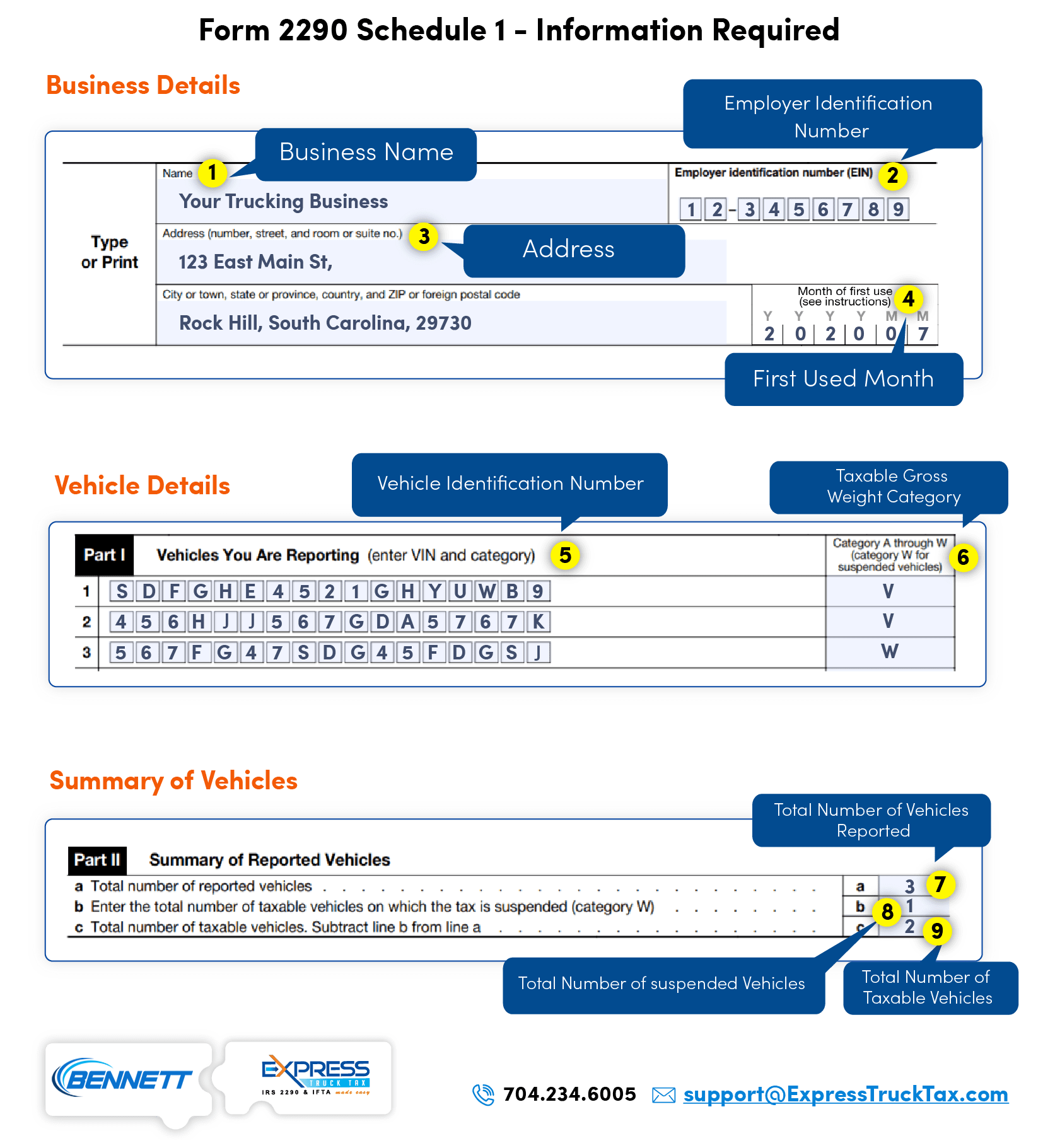

2290 returns until January 21 Schedule 1 (Form 2290)—Month of first use Form 2290 filers must enter the month of first use in Schedule 1 to indicate when the vehicles included in Schedule 1 were first used during the tax period See Month of first use under Schedule 1 (Form 2290), later, for more information US Customs and Border2290US IRS approved #1 2290 eFiling platform , get schedule 1 in minutes File HVUT online, 2290 Amendments, 49 Credit Request and Free VIN Corrections and RetransmissionForm 2290 Correction is used to correct the errors present in the original 2290 submissions Whenever the information of the vehicle changes, then it is mandatory by the IRS to file the amendments for the original Form 2290 There are three major kinds of amendments for which you need to file Form 2290 Correction

IRS 2290 Details Form 2290 must be filed the month after a taxable vehicle is first used on public highways during the current period The current period begins July 1 and ends June 30 of the following year The 2290 form must be filed by the last day of the month following the first month of use The filing rules apply whether you are payingIRS Form 2290 Online for 21 Paying Heavy Highway Vehicle Use Tax and getting Printable 2290 Form Schedule 1 is now within minutes Therefore, Form 2290 Online Filing started for the Tax Year 21 as quick as possible Truckers can file HVUT 2290 Form with 2290 Fling OnlineFurthermore, IRS Free efile Form 2290 is now possible with the irsform2290onlinecom ToForm 2290, Heavy highway motor vehicle use tax must be filed in their name if a Vehicle with a taxable gross weight of 55,000 pounds or more Form 2290 current filing season is July 1 through June 30 Form 2290 filers must file for the month you first use the taxable vehicle on public highways during the reporting period

Www Maine Gov Sos Bmv Commercial Hvut Pdf

Wordscapes Woods Mossy 2 Level 2290 Answers Qunb

May 26, 21 · Form 2290 is a Heavy Vehicle Use Tax Return filed with the IRS on an annual basis This return is filed to calculate and pay the Heavy Vehicle Use Tax (HVUT) for every tax year The HVUT paid for the heavy vehicles will be used for any maintenance, repair, or construction purposes in the highways 2Form 2290 is an IRS tax form that you need to file if you own a heavy vehicle weighing 55,000 pounds or more The IRS mandates that everyone who owns a heavy vehicle with 5000 miles or above in the odometer should file their form 2290 before the due dateForm 2290 is the Heavy Vehicle Use Tax Return It is the form used to figure out and pay the tax due on motor vehicles operating on public highways with a taxable gross weight of 55,000 pounds or more The taxation period runs from July 1st to June

Form 2290 Instructions In Normal People Language

Forma 2290 Que Es Y Como Llenarla

Jul 01, 21 · So, every year 2290 tax season begins from July 1st and ends by June 30th of the following year Furthermore, truckers must be aware that August 31st is the deadline to pay road taxes and file HVUT returns every calendar year Apart from these, if you've newly purchased a heavy vehicle that is taxable, then you must file 2290 returns by theESR 2290 Most Widely Accepted and Trusted Page 2 of 31 40 DESIGN AND INSTALLATION 41 Design Walls The maximum basic wind speeds for positive or negative transverse load resistance of HardieShingle™ (New HardieShingle®) panels, HardiePlank™ (Cemplank®, Prevail™, and RFC®) lap siding, Artisan® Lap Siding, and HardieShingle™ (New HardieShingle®) individual shinglesIRS Form 2290 is used by truck drivers as part of their federal tax return It is also known as a Heavy Highway Vehicle Use Tax Return The purpose of this form is for the truck driver to calculate and pay any taxes that may be due on the use of a motor vehicle with a

Tc Electronic Tc2290 Dt Desktop Controlled Plug In Sweetwater

2290 Home

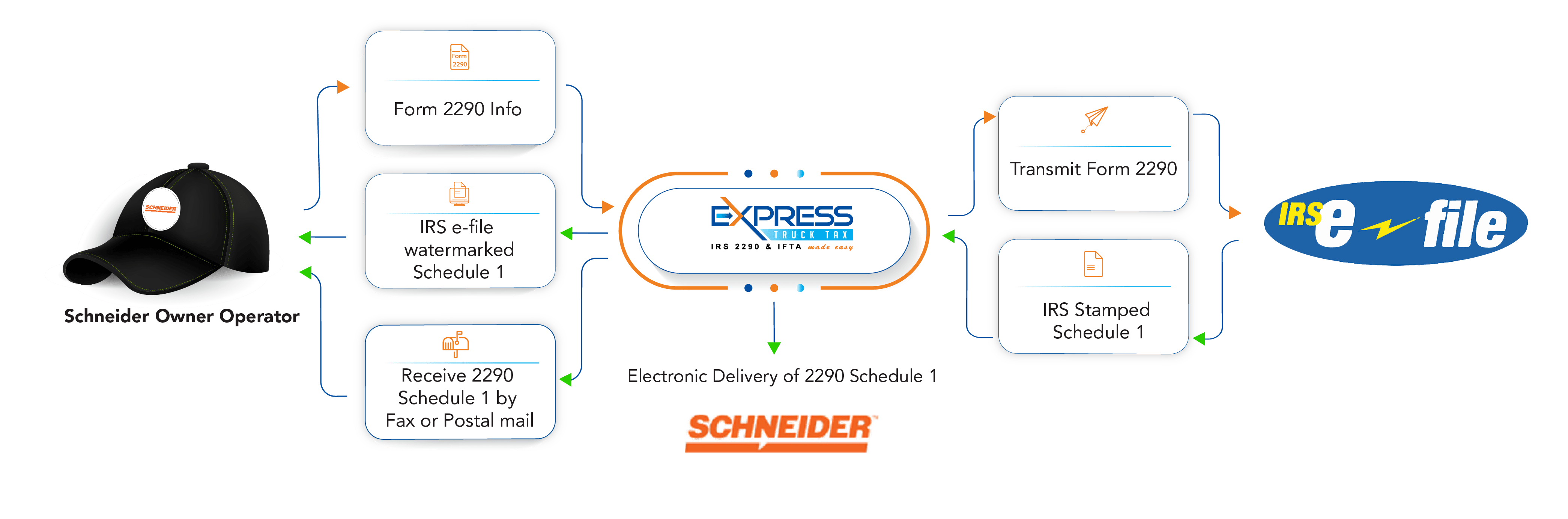

Transmit your 2290 Form to the IRS Our streamlined filing syncs directly with the IRS for the fastest efiling approval Receive your stamped Schedule 1 Get your stamped Schedule 1 in minutes so you can register and tag your vehicleThe IRS Tax Form 2290 to report and pay the federal heavy highway vehicle use taxes can be filed online at TaxExcisecom and Tax2290com, the first ever IRS Authorized Efile service provider for 2290 HVUT returns Top rated, inexpensive, market leader and truckers and owner operators first choice for 2290 electronic filing #2290efiling #tax2290 @taxexciseEFile your HVUT Form 2290 Tax Return Electronic filing is a result of modern technological evolution, Efiling your HVUT would save your valuable time & money Just by sparing few minutes towards efiling your Form 2290 using TruckDuescom, you can surpass scheduling appointments at the local IRS facility involving long queues

Www Cooperative Com Conferences Education Meetings Tax Finance Accounting Conference Eventmedia Page31 Bo5c form 2290 excise tax and heavy vehicles other considerations dunn Pdf

E File Form 2290 File 2290 Online Lowest Price 6 90

Form 2290, the heavy highway vehicle use tax returns are reported for 12 months period from July 21 through June 21 At Tax2290com we're accepting prefiling for the 2290 taxes, prefiling is advancing your 2290 preparation and receive the IRS Watermarked Schedule 1 proof copy on the first day when your returns is processedJul 01, 21 · IRS Form 2290 Online Filing Starts at $990 You don't have to rush to the IRS office and wait in a long queue to file Form 2290 Switch to Express2290 for a quick and smooth filing Experience and get your schedule 1 in minutes And it's only $990 forInstant 2290 is the IRS Heavy Vehicle Use Tax Form 2290 eFile experts with absolutely no hidden fees and 100% refund for services

Irs Hvut Form 2290 E File Hvut Form 2290 Online Filing Online Form 2290 Schedule 1 Precise2290 Com

Express2290 E File Form 2290 Online File 2290 For 21 22

Jun 30, 21 · Trust 2290online to quickly and efficiently efile Form 2290 for heavy vehicle use tax Efiling your 2290 form has never been easier with help from the nation's leader in transportation regulatory compliance Thousands of transportation professionals across the country rely on our expert insights to keep their drivers safe and compliantJul 01, 21 · The IRS Form 2290 is used to file Heavy Vehicle Use Taxes, or HVUT as it is commonly known Form 2290 must be filed on an annual basis for every heavy vehicle weighing at least 55,000 pounds All you need is your basic business details, as well as your Vehicle Identification Number or VIN, and also the Gross Vehicle WeightShop for Pantone® 2290 C samples and products on Pantone Convert Pantone® 2290 C color into RGB, Hex, and CMYK values

24 Printable Irs Form 2290 Templates Fillable Samples In Pdf Word To Download Pdffiller

Ez 2290 Irs Form 2290 Heavy Vehicle Taxes Home Facebook

Tax Form 2290, heavy motor vehicle use tax reporting The Heavy Highway Vehicle Use Tax is a tax imposed yearly by the IRS on anyone who owns and operates a heavy highway vehicle (Class 6, 7 and 8 trucks are included) with a taxable gross weight of 55,000 lbs or more on public roadsYou must file Form 2290 and Schedule 1 for the tax period beginning on July 1, , and ending on June 30, 21, if a taxable highway motor vehicle (defined below) is registered, or required to be registered, in your name under state, District of Columbia, Canadian, or Mexican law at the time of its first use during the period and the vehicle has a taxable gross weight of 55,000 pounds or moreFile Form 2290 online with eForm2290 an IRS approved eFile service provider eFile 2290 form now and save up to 75% off on your HVUT 2290 return

J J Keller 2290online Com Service For E Filing Form 2290

Irs Form 2290 E File What Is It E File Irs Form Federal Tax Forms Hvut 2290 Form 1099 Form

INSTANT 2290 is the original Form 2290 efile provider 100% satisfaction guaranteed 100% accuracy guaranteed 100% refundable When you sign up with i2290com, you can Prepare and efile your Heavy Vehicle Use Tax returnTax 2290 Electronic Filing 100% Secured Electronic filing is The Best way of reporting your Federal Heavy Highway Vehicle Use Tax Returns with the IRS Available 24X7, choose eFile and ease your 2290 tax reporting!We are now filing the July June 21 tax period File your IRS Form 2290 Online electronically, save time and money, and reduce preparation and processing errors Submit your 2290 return online and get your IRS Form 2290 Schedule 1 through our website within minutes No more waiting in line at the IRS or waiting for it to come in the mail!

Tractordata Com J I Case 2290 Tractor Photos Information

Etrucktax Form 2290 Filing

Form 2290 can be used for the following purposes Pay tax for heavy vehicles with a taxable gross weight of 55,000 pounds or more, which will be used during the period Report any vehicles, which are expected to be used within 5,000 or 7,500 miles and claim suspension from tax Claim credits for taxes paid on any taxable vehicles which are soldEach page of 2290 must reflect correct July 1stJune 30th tax period year Taxable Vehicles registered July 1stSeptember 30th may submit 2290's reflecting period beginning prior year or current year October 1stJune 30th may only submit 2290's reflecting period beginning in the current year ExemptionsApr 10, 19 · Summary of HR2290 116th Congress (19) Shutdown Guidance for Financial Institutions Act

Www Dot Nd Gov Divisions Mv Docs 2290filinginstructions Pdf

J J Keller 2290online Com Service For E Filing Form 2290

Our Trucking Family 2290Taxcom is a family owned business and has been active in the trucking industry since 1934 We've built our business on quality service and serving the needs ofEFile 2290 with IRS Approved most trusted Form 2290 efiling platform EZ2290 & get schedule 1 instantly Tax calculation, Bulk Filing, Free VIN Corrections, Refilings and moreForm 2290 should be filed for the month when the taxable vehicle is first used on the highway The filing rules apply whether you are paying the tax or reporting suspension of the tax View More If you are a large fleet owner or don't have time to efile form 2290 then no worries our tax expert support team will do the filing for you

Form 2290 Filing Irs 2290 Online File 2290 Electronically

Irs Form 2290 Clarksville Tn Online

Form 2290 is also required when the acquisition of used vehicles is done for the current tax period Vehicles that run less than 5,000 miles (7,500 miles for agricultural vehicles) are considered taxsuspended vehicles and they are not required to pay theTax 2290 is the first online tax efiling software provider for US federal heavy vehicle use tax (HVUT) for the form 2290 schedule 1 filed with the IRS Page 49 Tax 2290 Blog Efile IRS Form 2290, Highway motor truck taxes Toll Free Support@TaxExcisecomIRS encourages all tax payers to file Form 2290 online If you file 25 or more trucks on the same Form 2290, you are required to file the Form 2290 online That way the process would be much easier, faster and less mistakes

What Is Irs Tax Form 2290

Www Simple2290 Tax 2290 Online Filing Irs Hvut 2290 E Filing

Aug 31, · However, there are ways to prove to law enforcement that the Form 2290 obligation has been paid, according to the notice "A photocopy of the Form 2290 (with the Schedule 1 attached) that was filed with the IRS for the vehicle being registered, along with sufficient documentation that the taxpayer paid the tax due at the time the Form 2290 was filed," theIRS Form 2290, Heavy Vehicle Use Tax (HVUT) is a Federal Excise Tax that is imposed on heavy weight highway vehicles with gross weight of 55,000 pounds or more Owners of the heavy weight vehicles must file the Heavy Vehicle Use Tax (HVUT) annually through filing 2290 Form online and get their Stamped Schedule 12290onlinecom is one of many webbased, J J Keller ® applications designed specifically for the commercial motor vehicle market With 2290onlinecom, you can file IRS Form 2290 (Heavy Highway Vehicle Use Tax Return) quickly, easily and confidently When should I file?

Http Www Dmv Ri Gov Documents Forms Taxation Final 5 24 17 Form 2290 Dmv Guidance Doc W Attachments Pdf

The Evans 2290 E File Hvut Form 2290 Get Schedule 1 In Minutes

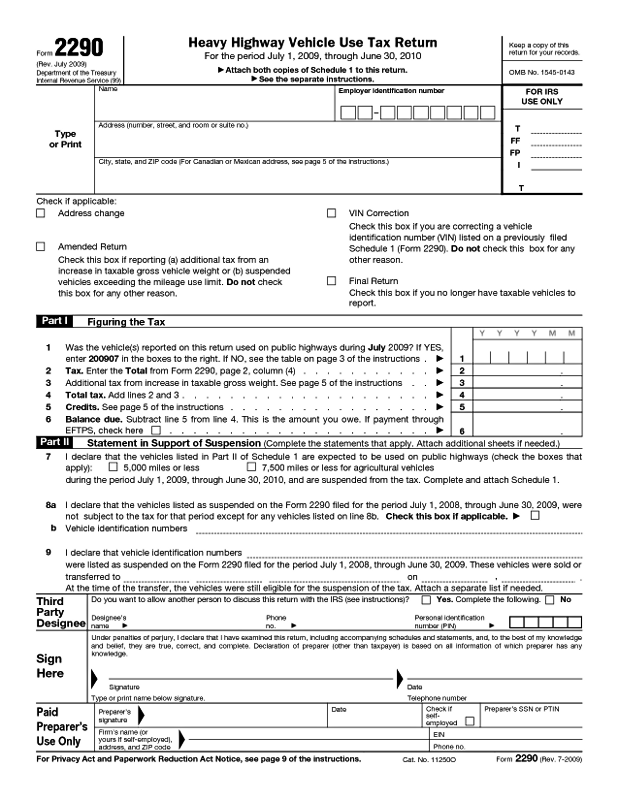

Form 2290 Heavy Highway Vehicle Use Tax Return

Backlog At The Irs May Delay Proof Of 2290 Payments Land Line

Form 2290 Due Date Information 2290online Com J J Keller

E File Irs Form 2290 2290 Online Filing For Just 6 90

E File Irs Form 2290 Heavy Vehicle Use Tax Hvut J J Keller

2290 Direct Form 2290 Online Filing

File Irs Form 2290 Online

E File Irs Form 2290 Heavy Vehicle Use Tax Hvut J J Keller

Heavy Vehicle Use Tax Form 2290 Federal Applications Processor

Keithley 2290 Series Tektronix

E File Form 2290 Online Irs Hvut Form 2290 E File Online Form 2290 Taxseer2290 Com

Faqs For Form 2290 Due Date Cost E Filing And More

How To File A 2290 Tax Form Atbs

Irs Form 2290 Due Date For 21 22 File 2290 Now

Form 2290 Rejected Irs Form 2290 Reasons For Rejection

What Form Do I Use To Pay The Heavy Highway Vehicle Use Tax

Form 2290 Schedule 1 How Do I Get A Copy Of My Paid 2290

Case 2290 Price Specs Review Attachments

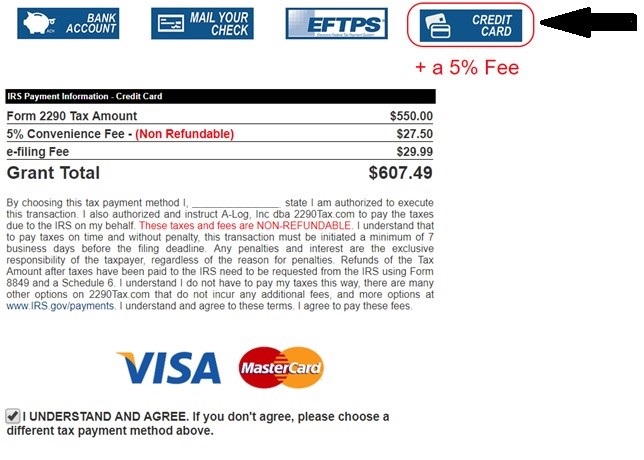

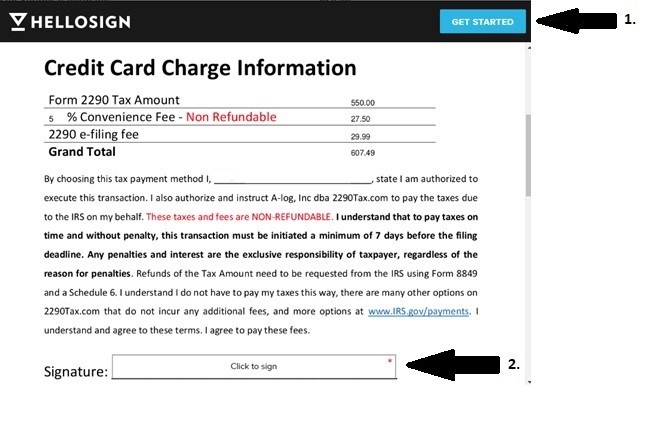

Credit Card 2290 Payment

Www Maine Gov Sos Bmv Forms Mv 2 heavy vehicle use tax 8 11 Pdf

Form 2290 Instructions In Normal People Language

How To File Your Own Irs 2290 Highway Use Tax Step By Step Instructions Youtube

Irs Form 2290 Online Heavy Vehicle Use Tax Hvut Return

Truck Tax Center Online Platform To E File 2290 Starts At 7 99

E File Irs Form 2290 Help Videos Expresstrucktax

Taxes For Truckers What Is Form 2290 1 800accountant

Irs Form 2290 Clarksville Tn Online

Irs Watermarked 2290 Proof Of Payment Schedule 1in Minutes Tax2290 Com

Gwtm 2290 E File Hvut Form 2290 Get Schedule 1 In Minutes

Form 2290 Schedule 1 How Do I Get A Copy Of My Paid 2290

Schneider 2290 E File Hvut Form 2290 Get Schedule 1 In Minutes

Irs Form 2290 Free Download Wondershare Pdfelement

Highway Use Tax 2290 800 498 90

Fast2290 Com

Adccge2umep2sm

Form 2290 Heavy Highway Vehicle Use Tax Return

Form 2290 An Overview Due Date Filing Methods Mailing Address

Irs Hvut Form 2290 E File Hvut Form 2290 Online Filing Online Form 2290 Schedule 1 Precise2290 Com

Fast 2290 Online Filing Rapid 2290

Learn How To Fill The Form 2290 Internal Revenue Service Tax Youtube

Jones 2290 E File Hvut Form 2290 Get Stamped Schedule 1 In Minutes

How To Write A Check For 2290 Dollars The Best Guide

Form 2290 Heavy Highway Vehicle Use Tax Return

Form 2290 Instructions In Normal People Language

Irs Form 2290 Instructions 21 22 What Is Form 2290

E File Form 2290 Online Irs Hvut Form 2290 E File Online Form 2290 Taxseer2290 Com

Credit Card 2290 Payment

Florida Form 2290 Heavy Highway Vehicle Use Tax Return

Office Of Highway Policy Information Policy Federal Highway Administration

24 Printable Irs Form 2290 Templates Fillable Samples In Pdf Word To Download Pdffiller

Mercer 2290 E File Hvut Form 2290 Get Schedule 1 In Minutes

2290 Efile Is Easy Fast Easy2290 Twitter

Office Of Highway Policy Information Policy Federal Highway Administration

Wp Zxufjefggsm

File 2290 Taxes Online Bulldog 2290

19 J I Case 2290 For Sale In Quincy Illinois Tractorhouse Com

3 11 23 Excise Tax Returns Internal Revenue Service

Tc Electronic Tc 2290 Dt

Hvut County Clerks Guide

Bennett 2290 E File Hvut Form 2290 Get Schedule 1 In Minutes

3 11 23 Excise Tax Returns Internal Revenue Service

Savox Sb 2290sg Servos Savox 2290 Savox Sb 2290 Sg Montaggio Rc Diesel

24 Printable Irs Form 2290 Templates Fillable Samples In Pdf Word To Download Pdffiller

Etrucktax Form 2290 Filing

Www Cooperative Com Conferences Education Meetings Tax Finance Accounting Conference Eventmedia Page31 Bo5c form 2290 excise tax and heavy vehicles other considerations dunn Pdf

Get Started With Form 2290 E File At Just 7 99

Irs Form 2290 Truck Tax Return Fill Out Online Pdf Formswift

Form 2290 Heavy Highway Vehicle Use Tax Return

Fillable Form 2290 21 22 Create Fill Download 2290

I R S F O R M 2 2 9 0 Zonealarm Results

Irs Form 2290 Online Filing 2290asap

Ez 2290 Irs Form 2290 Heavy Vehicle Taxes Home Facebook

Irs Form 2290 Free Download Wondershare Pdfelement

E File Form 2290 For 21 Get Schedule 1 In Minutes Ez2290

Tc Electronics 2290 Dynamic Digital Delay

Form 2290 Stamped Schedule 1 File Irs 2290 Tax Online

コメント

コメントを投稿